Kod: 04390229

Risk Management and Shareholders' Value in Banking - From Risk Measurement Models to Capital Allocation Policies

Autor Andrea Sironi

This book presents an integrated framework for risk measurement, capital management and value creation in banks. Moving from the measurement of the risks facing a bank, it defines criteria and rules to support a corporate policy a ... więcej

- Język:

Angielski

Angielski - Oprawa: Twarda

- Liczba stron: 808

Wydawca: John Wiley & Sons Inc, 2007

- Więcej informacji o książce

116.38 €

Zwykle: 118.74 €

Oszczędzasz 2.36 €

Dostępna u dostawcy

Wysyłamy za 15 - 20 dni

Zobacz książki o podobnej tematyce

-

Mechanics of Securitization - A Practical Guide to Structuring and Closing Asset-Backed Security Transactions

76.02 € -23 % -

Financial Accounting Theory and Analysis: Text and Cases

206.94 € -

Derivatives Essentials - An Introduction to Forwards, Futures, Options and Swaps

60.27 € -24 % -

Principles of Banking

94.72 € -24 % -

Risk Management and Financial Institutions, Sixth Edition

94.93 € -29 % -

Fundamentals of Modern Manufacturing - Materials, Processes and Systems, 7th Edition International Adaptation

68.91 € -

Securitization

307.17 € -

Modern Gentleman's Handbook

16.46 € -5 % -

Omoiyari

13.31 € -23 % -

Lucifer Omnibus Volume 2

89.85 € -27 % -

Soviet Cities

26.62 € -16 % -

Minimalist Woodworker

22.05 € -24 % -

BEASTARS, Vol. 13

14.53 € -

Glucose Revolution

17.37 € -29 % -

Secret Teachings of All Ages

33.13 € -18 % -

Swingers Sex Stories: Swinger's Lifestyles, Swinger's Parties

14.02 € -2 % -

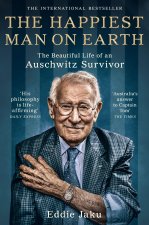

Happiest Man on Earth

10.87 € -27 % -

I'm Not a Giver-Upper

17.88 € -1 % -

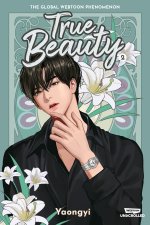

True Beauty Volume Two

16.05 € -21 % -

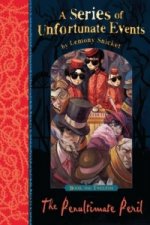

Penultimate Peril

8.73 € -20 % -

Dali The Wines of Gala

49.90 € -20 % -

1000 Chairs

19.91 € -1 % -

Chasing Daylight: How My Forthcoming Death Transformed My Life

14.32 € -29 % -

Ancient Armies of the Middle East

15.74 € -26 % -

Warded Man: Book One of The Demon Cycle

14.02 € -

W górach szaleństwa

5.17 € -12 % -

Akademia Pana Kleksa

7.61 € -16 % -

Tego lata stałam się piękna. Lato. Tom 1

7.61 € -26 %

Podaruj tę książkę jeszcze dziś

- Zamów książkę i wybierz "Wyślij jako prezent".

- Natychmiast wyślemy Ci bon podarunkowy, który możesz przekazać adresatowi prezentu.

- Książka zostanie wysłana do adresata, a Ty o nic nie musisz się martwić.

Więcej informacji o Risk Management and Shareholders' Value in Banking - From Risk Measurement Models to Capital Allocation Policies

Za ten zakup dostaniesz 290 punkty

Opis

Opis

This book presents an integrated framework for risk measurement, capital management and value creation in banks. Moving from the measurement of the risks facing a bank, it defines criteria and rules to support a corporate policy aimed at maximizing shareholders' value. Parts I - IV discuss different risk types (including interest rate, market, credit and operational risk) and how to assess the amount of capital they absorb by means of up-to-date, robust risk-measurement models. Part V surveys regulatory capital requirements: a special emphasis is given to the Basel II accord, discussing its economic foundations and managerial implications. Part VI presents models and techniques to calibrate the amount of economic capital at risk needed by the bank, to fine-tune its composition, to allocate it to risk-taking units, to estimate the "fair" return expected by shareholders, to monitor the value creation process. Risk Management and Shareholders' Value in Banking includes: Value at Risk, Monte Carlo models, Creditrisk+, Creditmetrics and much more formulae for risk-adjusted loan pricing and risk-adjusted performance measurement extensive, hands-on Excel examples are provided on the companion website www.wiley.com/go/rmsv a complete, up-to-date introduction to Basel II focus on capital allocation, Raroc, EVA, cost of capital and other value-creation metrics

Szczegóły książki

Szczegóły książki

116.38 €

- Pełny tytuł: Risk Management and Shareholders' Value in Banking - From Risk Measurement Models to Capital Allocation Policies

- Autor: Andrea Sironi

- Język:

Angielski

Angielski - Oprawa: Twarda

- Liczba stron: 808

- EAN: 9780470029787

- ISBN: 0470029781

- ID: 04390229

- Wydawca: John Wiley & Sons Inc

- Waga: 1552 g

- Wymiary: 252 × 177 × 49 mm

- Data wydania: 04. April 2007

Ulubione w innej kategorii

-

The Little Book That Still Beats the Market

24.89 € -14 % -

Market Wizards

22.66 € -24 % -

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

17.98 € -28 % -

The Alchemy of Finance

23.17 € -20 % -

Laughing at Wall Street

15.14 € -21 % -

New Trading for a Living - Psychology, Discipline, Trading Tools and Systems, Risk Control and Trade Management

61.69 € -25 % -

Warren Buffett Way Workbook

20.62 € -29 % -

Derivatives Analytics with Python - Data Analysis, Models, Simulation, Calibration and Hedging

97.57 € -7 % -

Financial Times Guide to Wealth Management, The

67.18 € -4 % -

Common Stocks and Uncommon Profits and Other Writings

23.17 € -20 % -

House of Morgan

25.81 € -

Fooled by Randomness

11.07 € -23 % -

Options, Futures, and Other Derivatives, Global Edition

75.11 € -

The Snowball

17.98 € -5 % -

Rule No. 1

11.37 € -28 % -

Where Are the Customers' Yachts? or A Good Hard Look at Wall Street

17.57 € -31 % -

Candlestick Course

52.03 € -31 % -

The Zurich Axioms

15.34 € -28 % -

Learn to Earn

13.92 € -28 % -

Study Guide to Technical Analysis of the Financial Markets

34.14 € -16 % -

New Market Wizards

15.85 € -19 % -

House of Rothschild

20.22 € -35 % -

Security Analysis: The Classic 1940 Edition

51.22 € -24 % -

Reading Price Charts Bar by Bar - The Technical Analysis of Price Action for the Serious Trader

55.90 € -31 % -

Beginner's Guide To Day Trading Online 2nd Edition

11.37 € -28 % -

Naked Forex - High-Probability Techniques for Trading without Indicators

70.94 € -6 % -

Tower of Basel

14.83 € -18 % -

Trade Your Way to Financial Freedom

30.38 € -28 % -

Value Investing - From Graham to Buffett and Beyond, Second Edition

28.45 € -25 % -

Art and Science of Technical Analysis - Market Structure, Price Action, and Trading Strategies

73.38 € -25 % -

Trading Price Action Trading Ranges - Technical Analysis of Price Charts Bar by Bar for the Serious Trader

57.32 € -26 % -

Little Book That Builds Wealth - The Knockout Formula for Finding Great Investments

20.22 € -30 % -

Trading Price Action Reversals - Technical Analysis Price Charts Bar by Bar for the Serious Trader

54.07 € -30 % -

Daily Trading Coach - 101 Lessons for Becoming Your Own Trading Psychologist

33.94 € -29 % -

Paths to Wealth Through Common Stocks

19.40 € -28 % -

Little Book of Behavioral Investing - How not to be your own worst enemy

18.39 € -28 % -

Bogleheads' Guide to Investing

20.62 € -26 % -

ETF Book, Updated Edition - All You Need to Know About Exchange-Traded Funds

27.13 € -28 % -

Trade Mindfully

52.34 € -28 % -

Fibonacci Applications and Strategies for Traders

79.78 € -23 % -

Wealth, War and Wisdom

15.34 € -24 % -

Investors Quotient - The Psychology of Successful Investing in Commodities & Stocks 2e

53.56 € -23 % -

Intelligent Investor

25.40 € -28 % -

Real Book of Real Estate

16.86 € -20 % -

Education of a Value Investor

26.32 € -15 % -

Reminiscences of a Stock Operator

19.30 € -29 % -

Trading Beyond the Matrix - The Red Pill for Traders and Investors

31.81 € -22 % -

The Dhandho Investor

27.33 € -24 % -

ABCs of Real Estate Investing

21.84 € -16 %

Osobní odběr Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk Wszelkie prawa zastrzeżonePrywatnieCookies

Vrácení do měsíce

Vrácení do měsíce Zdarma od 49.99 €

Zdarma od 49.99 € 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)