Kod: 20227701

Corporate Financial Performance of Mergers and Acquisitions in India

Autor Sushil Kumar Mehta, Zuhaib Ahmad Dugga

Book is based on the various objectives of Mergers and Acquisitions, as to why corporates go for the inorganic mode of growth. This study is conducted to get the impact of mergers and acquisitions of financial performance of acqui ... więcej

- Język:

Angielski

Angielski - Oprawa: Miękka

- Liczba stron: 56

Wydawca: LAP Lambert Academic Publishing, 2018

- Więcej informacji o książce

38.03 €

Zwykle: 42.15 €

Oszczędzasz 4.12 €

Dostępna u dostawcy

Wysyłamy za 9 - 11 dni

Zobacz książki o podobnej tematyce

-

Nights of the Creaking Bed

12.90 € -9 % -

Advances in Microbiology, Infectious Diseases and Public Health

152.55 € -

FUNDAMENTOS PRÁCTICOS DE COMUNICACIÓN NO VIOLENTA

23.20 € -

And Another Door Opens

22.59 € -

Shadoworld: Shadow of the Sun

10.89 € -2 % -

Roadmap to Renewal

34.40 € -19 %

Podaruj tę książkę jeszcze dziś

- Zamów książkę i wybierz "Wyślij jako prezent".

- Natychmiast wyślemy Ci bon podarunkowy, który możesz przekazać adresatowi prezentu.

- Książka zostanie wysłana do adresata, a Ty o nic nie musisz się martwić.

Więcej informacji o Corporate Financial Performance of Mergers and Acquisitions in India

Za ten zakup dostaniesz 95 punkty

Opis

Opis

Book is based on the various objectives of Mergers and Acquisitions, as to why corporates go for the inorganic mode of growth. This study is conducted to get the impact of mergers and acquisitions of financial performance of acquiring firms in India. The sample size for the current research is 36 companies which were involved in amalgamation process from 2010-2014. Pre three year and post three year data is used to test the significance of the study. Paired sample t-test statistics is used to test the significance of study. Paired sample t-test statistics is used on the various financial ratios with the help of statistical software SPSS. The overall results of this study show that there is an insignificant deterioration in the performance of the Indian companies. On the basis of the results of the current study it is concluded that overall financial performance of acquiring firms insignificantly deteriorated in the post- merger period. The capital performance of acquiring firms insignificantly deteriorated while the operating efficiency of firms insignificantly improved in after-Merger period. It is finally concluded that impact of M&A on the firms has insignificant impact.

Szczegóły książki

Szczegóły książki

38.03 €

- Pełny tytuł: Corporate Financial Performance of Mergers and Acquisitions in India

- Autor: Sushil Kumar Mehta, Zuhaib Ahmad Dugga

- Język:

Angielski

Angielski - Oprawa: Miękka

- Liczba stron: 56

- EAN: 9783659585302

- ID: 20227701

- Wydawca: LAP Lambert Academic Publishing

- Waga: 102 g

- Wymiary: 220 × 150 × 3 mm

- Rok wydania: 2018

Ulubione w innej kategorii

-

The Book of Bill

23.70 € -14 % -

Gravity Falls Journal 3

16.44 € -23 % -

Berserk Deluxe Volume 1

44.38 € -11 % -

Pumpkin Spice Cafe

10.28 € -28 % -

Berserk Deluxe Volume 2

52.25 € -

White Nights

3.93 € -15 % -

48 Laws Of Power

17.95 € -9 % -

It ends with us

8.67 € -19 % -

Atomic Habits

19.26 € -16 % -

A Little Life

17.55 € -

Berserk Deluxe Volume 3

48.82 € -3 % -

The 48 Laws of Power

24.51 € -5 % -

Jujutsu Kaisen, Vol. 23

10.69 € -18 % -

Surrounded by Idiots

10.48 € -29 % -

Berserk Deluxe Volume 4

45.19 € -10 % -

Iron Flame

16.23 € -18 % -

English File Fourth Edition Intermediate (Czech Edition)

24.31 € -12 % -

The Official Stardew Valley Cookbook

22.39 € -19 % -

Gilmore Girls: The Official Advent Calendar

28.85 € -18 % -

Chainsaw Man, Vol. 16

10.69 € -18 % -

Berserk Deluxe Volume 5

50.44 € -

Nexus: A Brief History of Information Networks from the Stone Age to AI

19.16 € -18 % -

A Good Girl's Guide to Murder

8.16 € -14 % -

A Curse For True Love

10.38 € -12 % -

It Starts with Us

10.69 € -17 % -

English File: Pre-Intermediate: Student's Book with Online Practice

24.31 € -12 % -

Psychology of Money

18.86 € -4 % -

The Husky and His White Cat Shizun: Erha He Ta de Bai Mao Shizun (Novel) Vol. 6

16.23 € -19 % -

Powerless

10.48 € -12 % -

Berserk Deluxe Volume 6

51.14 € -

English File: Intermediate: Student's Book with Online Practice

25.62 € -7 % -

Twisted Hate

10.18 € -14 % -

Court of Mist and Fury

9.37 € -21 % -

Little Stranger

16.64 € -2 % -

English File Fourth Edition Elementary Workbook with Answer Key

17.34 € -

Twisted Love

9.78 € -17 % -

Twisted Lies

9.78 € -17 % -

Reckless

10.28 € -20 % -

Gravity Falls: Lost Legends

17.75 € -15 % -

English File: Intermediate. Workbook with Key

17.34 € -

English File Upper Intermediate Student's Book with Student Resource Centre Pack (4th)

44.08 € -4 % -

Kid's Box New Generation Level 1 Activity Book with Digital Pack British English

11.49 € -

English File Fourth Edition Pre-Intermediate Multipack A

19.56 € -11 % -

Twisted Games

9.78 € -17 % -

Headway: Elementary: Student's Book with Online Practice

24.91 € -8 % -

Court of Thorns and Roses

9.27 € -19 % -

A is for Alien: An ABC Book (20th Century Studios)

5.84 € -19 % -

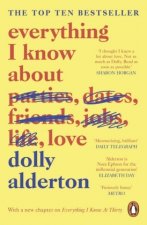

Everything I Know About Love

10.38 € -29 % -

Vagabond (VIZBIG Edition), Vol. 1

24.51 € -13 %

Osobní odběr Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk Wszelkie prawa zastrzeżonePrywatnieCookies

Vrácení do měsíce

Vrácení do měsíce Zdarma od 49.99 €

Zdarma od 49.99 € 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)