Code: 08928015

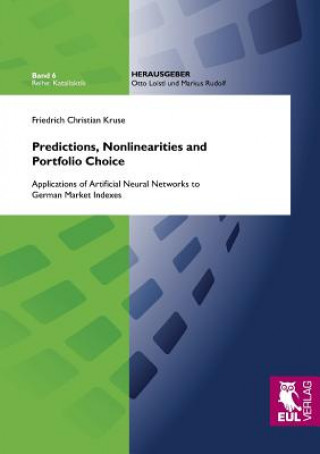

Predictions, Nonlinearities and Portfolio Choice

by Friedrich Christian Kruse

Finance researchers and asset management practitioners put a lot of effort into the question of optimal asset allocation. With this respect, a lot of research has been conducted on portfolio decision making as well as quantitative ... more

- Language:

English

English - Binding: Paperback

- Number of pages: 220

Publisher: Josef Eul Verlag Gmbh, 2012

- More about this

77.87 €

RRP: 79.51 €

You save 1.64 €

In stock at our supplier

Shipping in 15 - 20 days

You might also like

-

Trumpet-Major

23.57 € -

Ladder

22.16 € -

Miracle Mongers and Their Methods

19.54 € -

Grigori, El Caido

48.96 € -

Management Education for Global Sustainability

90.07 € -

Challenges in Volunteer Management

65.88 € -

Robert Burns. Les Oeuvres (Ed.1893)

33.24 €

Give this book as a present today

- Order book and choose Gift Order.

- We will send you book gift voucher at once. You can give it out to anyone.

- Book will be send to donee, nothing more to care about.

More about Predictions, Nonlinearities and Portfolio Choice

You get 196 loyalty points

Book synopsis

Book synopsis

Finance researchers and asset management practitioners put a lot of effort into the question of optimal asset allocation. With this respect, a lot of research has been conducted on portfolio decision making as well as quantitative modeling and prediction models. This study brings together three fields of research, which are usually analyzed in an isolated manner in the literature:- Predictability of asset returns and their covariance matrix- Optimal portfolio decision making- Nonlinear modeling, performed by artificial neural networks, and their impact on predictions as well as optimal portfolio constructionIncluding predictability in asset allocation is the focus of this work and it pays special attention to issues related to nonlinearities. The contribution of this study to the portfolio choice literature is twofold. First, motivated by the evidence of linear predictability, the impact of nonlinear predictions on portfolio performances is analyzed. Predictions are empirically performed for an investor who invests in equities (represented by the DAX index), bonds (represented by the REXP index) and a risk-free rate. Second, a solution to the dynamic programming problem for intertemporal portfolio choice is presented. The method is based on functional approximations of the investor's value function with artificial neural networks. The method is easily capable of handling multiple state variables. Hence, the effect of adding predictive parameters to the state space is the focus of analysis as well as the impacts of estimation biases and the view of a Bayesian investor on intertemporal portfolio choice. One important empirical result shows that residual correlation among state variables have an impact on intertemporal portfolio decision making.

Book details

Book details

Book category Books in English Economics, finance, business & management Business & management

77.87 €

- Full title: Predictions, Nonlinearities and Portfolio Choice

- Author: Friedrich Christian Kruse

- Language:

English

English - Binding: Paperback

- Number of pages: 220

- EAN: 9783844101850

- ISBN: 9783844101850

- ID: 08928015

- Publisher: Josef Eul Verlag Gmbh

- Weight: 268 g

- Dimensions: 210 × 148 × 12 mm

- Date of publishing: 13. September 2012

Trending among others

-

The Personal MBA 10th Anniversary Edition

31.43 € -

Personal MBA

14.30 € -22 % -

The Hard Thing about Hard Things

23.47 € -18 % -

Market Leader 3rd Edition Intermediate Coursebook & DVD-Rom Pack

34.15 € -6 % -

Slight Edge

16.72 € -19 % -

Secrets of Power Negotiating - 25th Anniversary Edition

22.76 € -4 % -

Good To Great

22.46 € -23 % -

Ready, Fire, Aim - Zero to GBP100 Million in No Time Flat

29.81 € -28 % -

EMPOWERED - Ordinary People, Extraordinary Products

23.37 € -28 % -

Motive - Why So Many Leaders Abdicate Their Most Important Responsibilities

19.34 € -30 % -

Venture Deals

36.16 € -30 % -

Business Essentials, Global Edition

92.08 € -

Millionaire Real Estate Agent

19.84 € -28 % -

Marketing 5.0 - Technology for Humanity

22.86 € -20 % -

Design Thinking Toolbox - A Guide to Mastering the Most Popular and Valuable Innovation Methods

30.02 € -20 % -

Corporate Finance

90.67 € -

ISE Fundamentals of Corporate Finance

78.58 € -

Influential Product Manager

38.38 € -5 % -

Chinese Business Etiquette and Culture

14.80 € -12 % -

Execution

22.46 € -27 % -

Buddha and the Badass

24.47 € -15 % -

Wealth Elite

19.64 € -18 % -

Lead with a Story: A Guide to Crafting Business Narratives that Captivate, Convince, and Inspire

21.85 € -23 % -

Thinking In Bets

17.72 € -15 % -

Eat That Frog!

14.10 € -29 % -

Toyota Way, Second Edition: 14 Management Principles from the World's Greatest Manufacturer

28.40 € -22 % -

Transformed: Moving to the Product Operating Model

34.35 € -1 % -

All About Asset Allocation, Second Edition

18.23 € -28 % -

The Millionaire Real Estate Investor

19.74 € -26 % -

The Fearless Organization

26.39 € -19 % -

The Machine That Changed the World

16.51 € -21 % -

The Goal

28.10 € -

Karmic Management

15.10 € -20 % -

4 Stages of Psychological Safety

18.53 € -19 % -

The Big Book of Dashboards

38.38 € -26 % -

Death by Meeting - A Leadership Fable About Solving the Most Painful Problem in Business

24.98 € -10 % -

Smart Couples Finish Rich

16.11 € -23 % -

Smart Women Finish Rich

17.82 € -11 % -

Ultimate Guide to Dropshipping

12.08 € -

Onward

14.20 € -25 % -

Art of Closing the Sale

16.61 € -17 % -

Introverted Leader

19.84 € -23 % -

Financial Freedom

17.82 € -15 % -

YouTube Formula - How Anyone Can Unlock the Algorithm to Drive Views, Build an Audience, and Grow Revenue

20.54 € -26 % -

When All Hell Breaks Loose

17.42 € -16 % -

Machine That Changed the World

12.99 € -24 % -

Bulletproof Problem Solving - The One Skill That Changes Everything

23.47 € -26 % -

Business Model Generation - A Handbook for Visionaries Game Changers and Challengers

30.22 € -19 % -

The Power of Full Engagement

19.94 €

Collection points Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk All rights reservedPrivacyCookies

15549 collection points

15549 collection points Delivery 2.99 €

Delivery 2.99 € 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)